Quarterly Market Outlook: April 2021

Strong recovery opens the debate on rates

The widespread immunization we’ve all been waiting for is starting to materialize. Disparity in vaccination and uneven varied fiscal and monetary stimulus imply that the speed at which countries will return to normality will also be varied. The United States and China, the world’s leading economies, are making noteworthy progress, which has been reflected in improving growth outlooks for 2021.

Strong recovery is also confirmed by rising business confidence surveys and has provoked tension in fixed-income markets as long-term interest rates are reaching higher levels. The perfect scenario for investors (end of the crisis and tax relief for risk assets, and low interest rates for conservative fixed-income assets) is starting to deteriorate as the need to keep interest rates low to maintain the economy afloat is expected to last less than initially thought.

Our report analyzes equity market behavior during reflation and economic reactivation periods in the past, and confirms that the current environment still favours credit assets and equities over liquidity and long-term bonds. We maintain our recommendation of investment portfolios sensitive to economic recovery, cyclical rotation and assets that hedge against higher inflation.

01. Record (but uneven) recovery

The main economic recovery scenario we anticipated for 2021 is playing out as expected, despite back-to-back waves of the virus in several geographies.

The vaccines’ successful immunization (especially with the most vulnerable groups) is making all the difference. Vaccines are becoming available and administered at very different rates across geographies; still, the speed and large variety of effective vaccines is a triumph unlike any other. Vaccines have, therefore, been key and the best news since the start of this year (along with the authorities’ commitment to fiscal stimulus to support households and families throughout the difficult and complex normalization process).

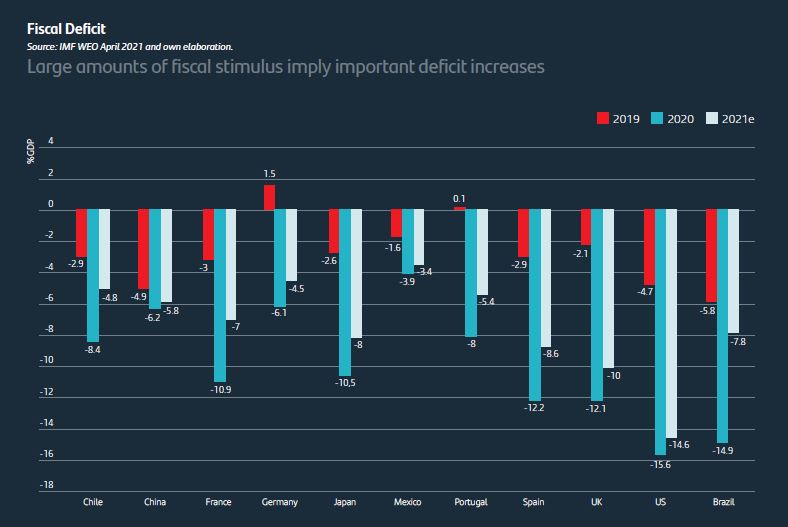

The different amount of fiscal stimulus packages of countries that took unprecedented measures in 2020 is having a major effect on the speed and vigour of recovery. So far, programmes have helped counter part of the damage spurred by lockdowns. The IMF estimates that, without such extraordinary policies, growth would have been three-times slower and more jobs would have been lost.

The combination of the above variables is driving indicators at a global level both for real economy (industrial manufacturing, international trade, retail) and also in terms of confidence to show significant improvement, suggesting that growth in the next quarters -and in 2021 as a whole- will be higher than ever, following the worst economic slump in history caused by the pandemic.

02. Markets are thinking about interest rates

This cycle of economic recovery is markedly different to traditional cycles for taking roots from a health crisis (as opposed to financial or macroeconomic imbalances) and the scale of stimulus packages. That’s why recovery will be quicker than in previous cycles, and services will likely recover with the same intensity as manufacturing once immunization is achieved. This has been evident in China’s economic performance, while a similar shift is expected in the US in Q2. In the US, consumption is rising due to the financial buffer households have built through saving.

Economic experts are probing how this accumulation of pent-up demand will affect inflation once restrictions are lifted.

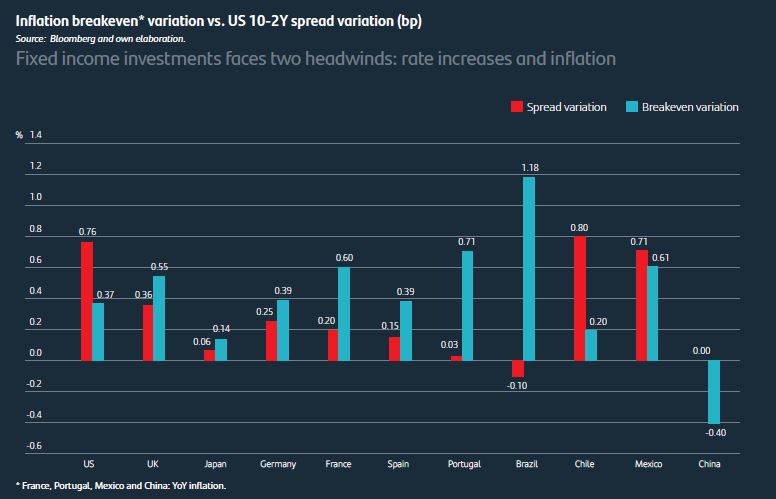

Although the short-term rise in inflation is evident, we believe it’s a one-off and a dramatic shift in the balance of pricing levels is unlikely. New inflation forecasts are based on better macroeconomic outlooks, rising commodity prices and shortages in the manufacturing industry. As and when growth returns to normal, we expect to see forecasts stabilize at 2.5% (the highest of 25 years). In the following chart we can see how medium-term inflation expectations (breakeven) in the medium term cause investors to demand a temporary premium thus increasing the yields of long-term debt relative to short-term debt (the slope).

03. Cyclical rotation and reflation

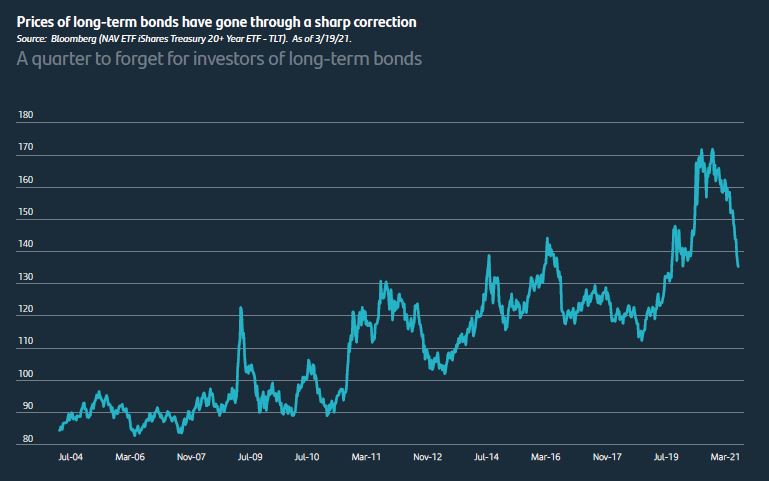

The good news about economic recovery are bad news for holders of long-term fixed-income securities due to the inverse correlation between higher rates and bond prices. The graph below shows, very long-term bond prices (e.g., +20-year US Treasury Bond ETF) fell more than 13% in the first quarter, one of the most significant corrections in history.

We consider staying underweight in long-term fixed income in the coming months is best on the assumption that yields will continue to rise on the long end of the curve. Long-term yields will face upward pressure first from strong growth, and later from higher inflation. Therefore, we still recommend diversifying in high-yield bonds (rated below investment grade).

Although the current situation is a far cry from past recoveries and inflation, we maintain that rising interest rates at the beginning of the cycle and robust economic recovery and business profits is suitable for investing in stocks. Confidence in the recovery is growing, around the world and the markets are pricing-in the post-pandemic economy. As long as bond yields do not rise enough to trigger a recession, we believe stocks will shrug off the effect of higher yields.

Would you like further information?