Nearshoring: An opportunity for Latin America

Labour costs, logistics disruption and geopolitical risks are driving the nearshoring phenomenon

China's entry into the World Trade Organisation (WTO) in 2001 generated a dynamic of globalisation in manufacturing in which a relevant part of the developed economies' production chain relocated to Asia in search of lower labour costs. Logistics and transportation processes achieved efficiency levels that minimized the distance factor. In addition, China and the United States strengthened their geopolitical ties, with new synergies in fields such as finance. However, these three factors that favoured globalisation have been replaced in recent years by structural factors:

- As a result of COVID-19 and the subsequent reopening, supply chains experienced major disruptions that led to shortages of all types of godosand took many months to stabilize.

- China gradually shifted from basic manufactures to more complex ones that are classed as strategic and critical to the United States. An increased competitiveness in China combined with a growing trade deficit, led to tension in trade relations that came to a head during the Trump administration and continue to this day under Biden.

Security of supply is now paramount

The United States decided in October 2022 to restrict China's access to any element associated with chip production that is from the U.S. or incorporates U.S. technology. USA lead this industry but accounts for only 13% of global chip productiom, a fact that is identifies as a supply chain risk. The free trade agreement between the United States, Mexico and Canada (USMCA, formerly NAFTA) is a very positive factor in this context.

Geographic proximity is decisive

Mexico's land border with the United States is more than 3,000km long and, according to Statista, more than 80% of exports are made by land. This represents a major advantage as it avoids bottlenecks in maritime transport. In addition, proximity allows trade not only in finished goods but also in intermediate goods, as well as joint production, which is an incentive for U.S. companies to invest.

The labour market plays a key role in three ways: costs, availability and demographics

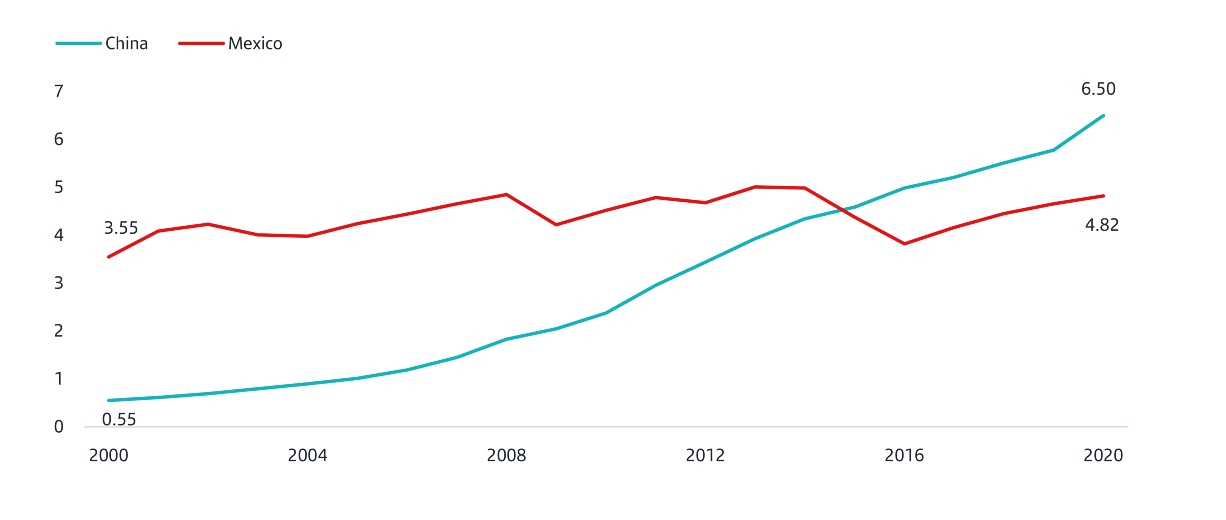

China's competitive advantage in terms of lower labourcosts has disappeared since 2015, as can be seen in the chart below. In terms of production costs, the hourly wage in Mexico (USD 4.82) at the end of 2020 was 25% lower than in China (USD 6.50).

Manufacturing labour costs per hour: China vs. Mexico (USD)

Source: https://www.statista.com/statistics/744071/manufacturing-labour-costs-per-hour-china-vietnam-mexico/

Nearshoring is defined as the outsourcing strategy under which a company transfers part of its production to third parties in other countries that are nearby and in a similar time zone. According to 2022 estimates by the Inter-American Development Bank (IDB), nearshoring could add USD 78 billion per year in annual exports of goods (USD 64bn) and services (USD 14bn) from Latin America and the Caribbean in the short to medium term.

What is nearshoring?

Latin America's opportunity: USD 78 billion, with Mexico as the main beneficiary

The IDB announced its support for the Mexican government's plans to promote nearshoring. This is a commitment by the IDB and its private sector arm, IDB Invest, to help Mexico seize the enormous new opportunities resulting from the reconfiguration of global supply chains. Nearshoring is expected to drive many industrial processes in Mexico and throughout Latin America in the coming years.

The need to increase security of supply, diversify production chains and limit technology transfer to China make Mexico more attractive as an investment target for U.S. companies.