Robotics and automation

The robotics industry has entered a more dynamic phase of development and we believe it will become dominant over the next decade

-

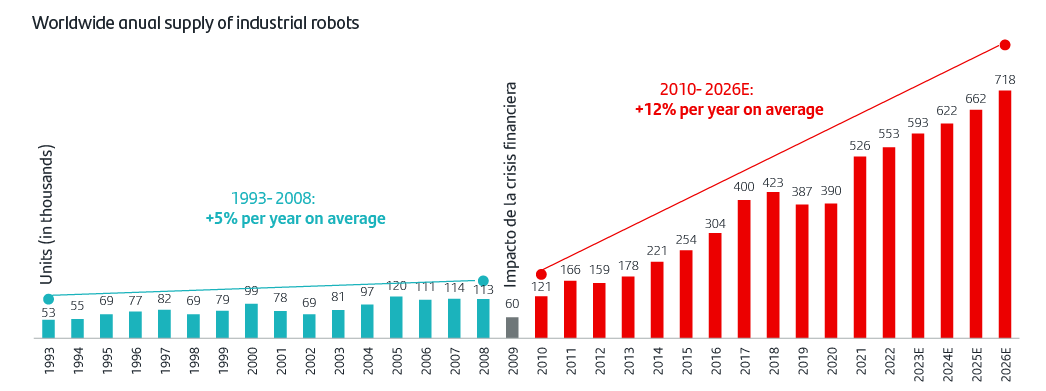

12%

Average annual growth in the supply of industrial robots from 2009 to 2026E1

Source: IFR World Robotics 2023 Report.

-

$374 billion

market for autonomous vehicles in 2030

Source: https://www.businessresearchinsights.com/es/market-reports/toc/autonomous-vehicles-market-106395

-

3/10 companies

European manufacturing companies reported production constraints in 2022 due to a shortage of workers

What do we mean by robotics?

Robotics is an interdisciplinary scientific field that combines various branches of engineering to create robotic machines designed to perform automated tasks and functions that, in some cases, simulate human capabilities and skills. The main difference between robotics and automation lies in both approach and functionality. Robotics focuses on designing, building and programming specific robots to perform particular tasks, while automation refers to the process of automating tasks using technology, which may include, but is not limited to, robots.

The robotics industry has entered a more dynamic phase of development. The EU's Robotics 2020 Strategy sums up the outlook as follows: Robotic technology will become dominant over the next decade. It will shape all aspects of work and home. Not only is Robotics transforming existing industries, from manufacturing and healthcare to agriculture and services, but it is also paving the way for new sectors to emerge.

With its ability to boost productivity, cut costs and help solve the problems linked to global labour shortages, we believe growth in robotics and automation may outpace that of the economy as a whole. This offers a thematic investment opportunity, both in the companies that manufacture robots and in those that provide all the necessary components, from semiconductors to software.

Main drivers

Labour shortages

The global working-age population is declining and labour shortages are disrupting supply chains across all sectors.

Competition to attract talent could become fiercer in the next decade as the baby boom generation retires and the global birth rate continues to decline.

High labour costs

On average, labour costs have risen globally. Following moderate increases in the second half of 2023, labour costs in the US registered their largest year-on-year increase in the first quarter of 2024 despite the Biden Administation's subsidies and stimulus policies.

This is coupled with the decline in the cost of implementing robots in recent years, which is driving sales of industrial robots.

Artificial Intelligence (AI) and Computing

Continuous improvements in AI and machine learning are making automation systems smarter and more adaptable. This means that the robots of the future will not be confined to performing repetitive tasks, but will also make complex decisions, analyse data in real time and learn from their environment, thus improving productivity and reducing human error.

Reshoring and nearshoring

Supply bottlenecks during the COVID-19 pandemic highlighted the dangers of relying on distant countries for manufacturing. Geopolitical tensions between the US and China, along with the Ukraine war, compounded the pressure on global supply chains. As a result, governments and companies are increasingly looking to move production to their home territories, a process known as “reshoring” and “nearshoring”. This should spark an increase the demand for industrial robots to work in these new factories, as well as for other automation equipment and software solutions.

Important Legal Information

This document has been prepared by Banco Santander, S.A. ("Santander") for information purposes only and is not intended to be, and should not be construed as, investment advice, a prospectus or other similar information material. This material contains information compiled from a variety of sources, including business, statistical, marketing, economic and other sources. The information contained in this material may also have been compiled from third parties, and this information may not have been verified by Santander and Santander accepts no responsibility for such information. Any opinion expressed in this document may differ from or contradict opinions expressed by other members of Santander. The information contained in this material is of a general nature and is provided for illustrative purposes only. It does not relate to any specific jurisdiction and is in no way applicable to specific situations or individuals. The information contained in this document is not an exhaustive and formal analysis of the issues discussed and does not establish an interpretative or value judgement as to their scope, application or feasibility. Although the information contained in this document has been obtained from sources that Santander believes to be reliable, its accuracy or completeness is not guaranteed. Santander assumes no responsibility for the use made of the information contained herein.