Thematic Funds

Thematic investing refers to strategies through which investors can invest in megatrends, capturing opportunities arising from structural changes in society that transcend economic cycles. In other words, thematic investing is about transforming megatrends into investment opportunities.

-

16

Investment themes

-

35

Funds on offer

-

1.5

€bn under management

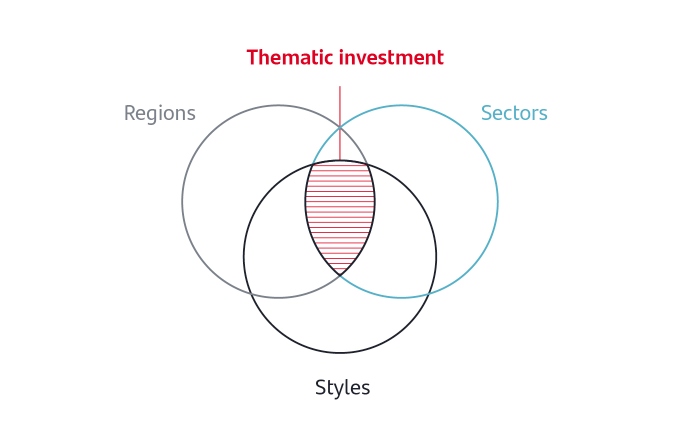

1. A new dimension in portfolio construction

Thematic investment transcends asset, sector, regional and style classifications, but without being totally independent of them, and takes account of the megatrends shaping society: demographics, social changes, resource scarcity, technological progress, environmental impact, etc.

2. Increased portfolio efficiency and diversification vs. global indices

The fact that the investment universe of thematic funds is usually narrower than that of conventional global equity funds could entail a higher specific risk. However, their specific nature usually results in low overlap with global equity funds, which improves the diversification and efficiency of the portfolio in aggregate.

Unconstrained approach

These funds usually have no benchmark index associated with portfolio construction and mostly use the MSCI ACWI global index only for performance comparison purposes.

Looking beyond global indices

Thematic funds generally have a low overlap with global equity indices; in many cases, this is because they do not have a clear index to benchmark against; in other cases, because the index is not fully representative.

3. Faster revenue growth versus global equities

In recent years, revenues of companies in the thematic universe have increased faster and more steadily than those of other listed equities. One way to look at this is to take the revenue growth of companies in the thematic universe (equally weighted) over multiple business cycles and then examine the standard deviation of this growth over time.

4. Beyond the focus on "growth"

The thematic approach examines structural trends spanning all sectors and selects companies that are exposed to them and can, therefore, benefit from this extra long-term growth. However, though most funds in the thematic universe are biased towards growth, this is not a specific factor that defines thematic investing since themes can be relevant to companies at all stages of their business cycle.

5. A complement to industry funds

Thematic funds also provide a degree of diversification when compared with conventional industry funds. As an example, we analyse one thematic fund that we identified internally in our universe with the greatest exposure to a single sector: Robeco New World Financials. We see that its portfolio differs significantly not only from the relevant world index (MSCI AC World Financials) but also from the sector funds in the same Morningstar equity category (Financial Services), which translates into an increase in the diversification of the portfolio in aggregate.

6. Thematic investment as a way to increase portfolio sustainability

Many of thematic investment strategies are also vehicles that contribute to increasing sustainability by providing solutions to specific social and environmental challenges. This is evident in the case of a fund that invests in renewable energy, for example. However, it is worth clarifying that sustainability doesn't hinge only on environmental issues: social issues such as health, education and gender equality are also important.

The Sustainable Development Goals (SDG) provide a framework for investing in the key issues of the sustainability agenda. As a result, many thematic funds are aligned with specific social and/or environmental objectives, going beyond whether the companies in which they invest are managed on the basis of ESG (Social, Environmental and Governance) criteria.

Important Legal Information

This report was prepared by SANTANDER Wealth Management Global Division (“WM”, together with Banco Santander, S.A. and its affiliates shall be hereinafter referred to as “Santander”). This report contains information gathered from several sources and economic forecasts. The information contained in this report may have also been gathered from third parties. All these sources are believed to be reliable, although the accuracy, completeness or update of this information is not guaranteed, either implicitly or explicitly, and is subject to change without notice. Any opinions included in this report may not be considered as irrefutable and could differ or be, in any way, inconsistent or contrary to opinions expressed, either verbally or in writing, advices, or investment decisions taken by other areas of Santander.This report is not intended to be and should not be construed in relation to a specific investment objective. This report is published solely for informational purposes. This report does not constitute an investment advice, an offer or solicitation to purchase or sell assets, services, financial contracts or other type of contracts, or other investment products of any type (collectively, the “Financial Assets”), and should not be relied upon as the sole basis for evaluating or assessing Financial Assets. Likewise, the distribution of this report to a client, or to a third party, should not be regarded as a provision or an offer of investment advisory services. Santander makes no warranty in connection with any market forecasts or opinions, or with the Financial Assets mentioned in this report, including with regard to their current or future performance. The past or present performance of any markets or Financial Assets may not be an indicator of such markets or Financial Assets future performance. The Financial Assets described in this report may not be eligible for sale or distribution in certain jurisdictions or to certain categories or types of investors. Except as otherwise expressly provided for in the legal documents of a specific Financial Assets, the Investment Products are not, and will not be, insured or guaranteed by any governmental entity, including the Federal Deposit Insurance Corporation. They are not an obligation of, or guaranteed by, Santander, and may be subject to investment risks including, but not limited to, market and currency exchange risks, credit risk, issuer and counterparty risk, liquidity risk, and possible loss of the principal invested. In connection with the Financial Assets, investors are recommended to consult their financial, legal, tax and other advisers as such investors deem necessary to determine whether the Financial Assets are suitable based on such investors particular circumstances and financial situation. Santander, their respective directors, officers, attorneys, employees or agents assume no liability of any type for any loss or damage relating to or arising out of the use or reliance of all or any part of this report. Costs incurred for purchasing, holding or selling Financial Assets may reduce returns and are not reflected in this report. At any time, Santander (or employees thereof) may have positions aligned or contrary to what it is stated herein for the Financial Assets, or deal as principal or agent in the relevant Financial Assets or provide advisory or other services to the issuer of relevant Financial Assets or to a company connected with an issuer thereof. This report may not be reproduced in whole or in part, or further distributed, published or referred to in any manner whatsoever to any person, nor may the information or opinions contained therein be referred to without, in each case, the prior written consent of WM. Any third-party material (including logos, and trademarks), whether literary (articles/ studies/ reports, etc. or excerpts thereof) or artistic (photos/graphs/drawings, etc.), included in this report is registered in the name of its respective owner and only reproduced in accordance with honest industry and commercial practices.