Green hydrogen

Fuelling a sustainable future

Hydrogen is the most abundant and simplest chemical element on the planet; it is present in 75% of matter. Humanity has been using it as a raw material in the chemical and metallurgical industries for over 100 years. Additionally, it is light, can be stored and does not, in itself, generate emissions, so it is a perfect candidate for a sustainable fuel1.

Hydrogen cannot be obtained directly from nature; it needs to be manufactured. The process used determines whether this fuel is clean. When produced from renewable energy sources, hydrogen is one of the fuels of the future.

According to S&P Research, green hydrogen is one of the top ten cleantech trends in 2024, and it is becoming a key part of net zero plans to decarbonizing hard-to-abate sectors. It also offers major opportunities for historically energy dependent countries2,3. It can increase developing countries’ overall resilience while driving the creation of a diversified and knowledge-based economy4.

The need for hydrogen is not new, but its use to achieving decarbonization can increase significantly

Hydrogen has traditionally been used as an input across carbon intensive industries that are more difficult to decarbonize, the so-called hard-to-abate sectors.

It is not a primary energy source; rather, it is an energy vector, which means that it requires a chemical process to be produced2. Non-renewable hydrogen is extracted from fossil gas, a process that releases CO2 emissions while green hydrogen is extracted from water using renewable energy in the process3.

Types of hydrogen, based on the manufacturing process

Blue hydrogen

Green hydrogen

Green hydrogen...

-

1

Is a clean fuel

-

2

Is storeable and transportable

-

3

Is efficient in combustion and charging time

-

4

Fosters energy independence

-

5

Could be a game changer for developing countries

-

6

Requires no trade-off with agriculture

Green hydrogen maths: investments and potential

The hydrogen chain will require USD 9.4 trillion in total of investments through 2050, USD 3.1 trillion of which in developing economies, mainly for technology development and renewable energy.

Investments are key to overcoming the following challenges:

Lower production costs

Higher efficiency

Adequate infrastructure

Growing potential

Demand growth

By 2050, total global demand for hydrogen may be 4 to 6 times the current levels8.

-

From

c. 1Mt

(million metric tons)of green hydrogen supply out of 100Mt total current production4,8

-

To

c. 500 Mt

of green hydrogen supply mainly for industrial and transportation sectors4

The breakeven

The cost of hydrogen installations could decrease 40 to 80%, which coupled with lower renewable energy prices, could drive green hydrogen to profitability by 20301.

The solution

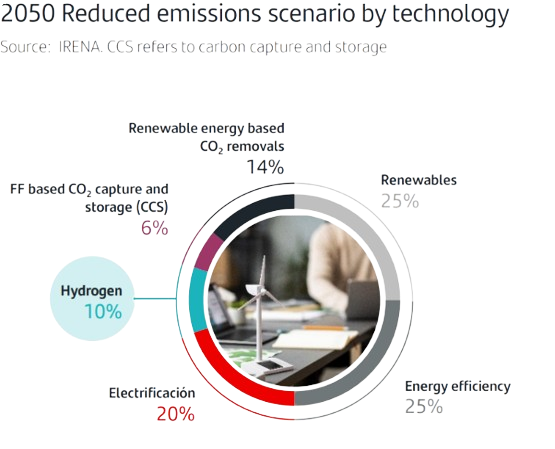

In 1.5ºC scenario clean hydrogen could represent c.10% of the needed emissions reduction by 20506.

About regulation9

A growing number of countries and companies are engaged in intense competition for leadership in clean hydrogen technologies.

Supportive policies will be needed to meet targets and achieve the necessary installed capacity by 2050.

Plans by geography

The EU aims to produce 10 Mt of green hydrogen and import an additional 10 Mt by 203010, as it is considered a major contributor to reduce dependence on imports of Russian fossil fuel. Despite Europe’s leading position on announced volumes, the maturity of theproject funnel is low with only 5% committed volumes. In 2022, hydrogen accounted for less than 2% of Europe’s energy consumption with 96% of it produced from natural gas.

Despite low announced volumes, China has the highest commitments, about 40% of the total announced supply in China is already committed while in North America, the share drops to 20%. The low announced volumes in China could be due to fewer companies announcing their plans or different public support schemes. In North America, more than 70% of the announced volumes is low carbon hydrogen (blue), mainly driven by the tax credits received for CO2 capture and storage boosted by the IRA.

Decarbonizing highly polluting industries: green steel11

H2 Green Steel, headquartered in Stockholm, was founded in 2020 and aims to build a large-scale green steel production facility using a combination of renewable electricity and green hydrogen, thus eliminating almost all the CO₂ emissions from the conventional steelmaking process.

Going forward, the production costs of conventional polluting methods are expected to rise significantly.

Access to cheap, stable renewable electricity throughout the day and the year is the main prerequisite for the H2 Green Steel project.

Conclusions

Green hydrogen could represent 10% on the expected mix of renewable energy technologies facing the emissions reduction required to reach Net Zero by 2050, posing a promising alternativefor several hard-to-abate industries. The main existing challenges are electrolyzers technology, efficiency and infrastructure. A specific policy development could be a catalyst for this sector.

Green hydrogen can be transported and stored. It could be a game changer for countries with high renewable energy resources. Additionally, it can play an important role in ensuring countries´ energy independence.

1. Acciona: https://www.acciona.com/green-hydrogen/?_adin=02021864894

2. Business Norway: https://businessnorway.com/articles/norway-poised-to-lead-green-hydrogen-marketgad_source=1&gclid=EAIaIQobChMIqO7YkoXYhQMVFUlBAh05Ag4oEAAYASAAEgLcq_D_BwE

3. IMF: https://www.imf.org/en/Publications/fandd/issues/2022/12/hydrogen-decade-van-de-graaf

4. Deloitte: https://www2.deloitte.com/content/dam/Deloitte/at/Documents/presse/at-deloitte-wasserstoffstudie-2023.pdf

5. The Economist impact: https://impact.economist.com/sustainability/projects/the-future-of-hydrogen/hydrogen-why-this-time-is-different.html

6. S&P Global: https://www.spglobal.com/commodityinsights/es/market-insights/special-reports/energy-transition/top-ten-cleantech-trends-in-2024

7. Linkedin articles: https://www.linkedin.com/pulse/green-hydrogen-challenges-amit-ahuja-mkaac/

8. IRENA:

https://www.esmap.org/sites/default/files/2022/2023/H4D/Full_Slide_deck_Scaling%20Hydrogen%20Financing%20for%20Development_November17.pdf

9. IRENA: https://www.irena.org/Energy-Transition/Policy/Policies-for-green-hydrogen#Policies-to-support-electrolysers

10. Hydrogen council and McKinsey: https://hydrogencouncil.com/wp-content/uploads/2023/05/Hydrogen-Insights-2023.pdf

11. OECD:

https://www.oecd.org/en/about/programmes/clean-energy-finance-and-investment-mobilisation/greenhydrogen.html#:~:text=H2%20Green%20Steel%2C%20headquartered%20in,from%20the%20traditional%20steelmaking%20process

12. European commission: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/what-eu-ets_en

13. US Department of energy: https://www.energy.gov/eere/fuelcells/articles/fuel-cells-fact-sheet

Important Legal Information

This document has been prepared by Banco Santander, S.A. ("Santander") for information purposes only and is not intended to be, and should not be construed as, investment advice, a prospectus or other similar information material.

This material contains information compiled from a variety of sources, including business, statistical, marketing, economic and other sources. The information contained in this material may also have been compiled from third parties, and this information may not have been verified by Santander and Santander accepts no responsibility for such information.

Any opinion expressed in this document may differ from or contradict opinions expressed by other members of Santander. The information contained in this material is of a general nature and is provided for illustrative purposes only. It does not relate to any specific jurisdiction and is in no way applicable to specific situations or individuals. The information contained in this document is not an exhaustive and formal analysis of the issues discussed and does not establish an interpretative or value judgement as to their scope, application or feasibility. Although the information contained in this document has been obtained from sources that Santander believes to be reliable, its accuracy or completeness is not guaranteed. Santander assumes no responsibility for the use made of the information contained herein.