The transition to a low-carbon economy, the biggest challenge of this century

Transitioning to a low-carbon economy requires a sweeping transformation of production, consumption, and transport. Energy accounts for more than three-quarters of greenhouse gas (GHG) emissions globally and holds the key to avoiding the worst effects of climate change1.

Achieving Net Zero by 2050 is estimated to require an average investment of USD 4.84 trn per year through 2030, almost triple current levels2. This mobilisation of capital will be fuelled by increased policy support, a change in the energy mix towards renewables, and growing use of low-carbon technologies3.

Why transition to a low-carbon economy?

Tackling climate change through an orderly and just transition to net zero by 2050 could result in a 7% increase in GDP compared to GDP forecasts under current policies4.

7%

Increase in GDP

The new energy paradigm

After the mid-2030s, renewables are expected to increase their contribution to meeting electricity demand considerably and will start to replace fossil fuel reliance. In 2022, the share of renewables in the global energy mix was around 31% and it is expected to rise to 82% by 2050, driven by declining costs of solar, wind, and storage technologies5.

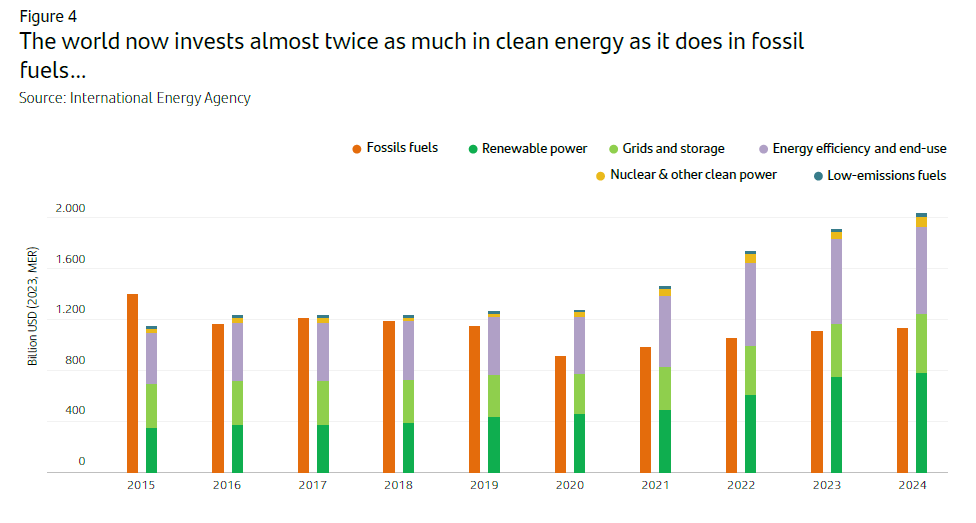

For every USD 1 spent on fossil fuels, USD 1.8 is being spent on clean energy. Investment in clean energy is likely to increase considerably in the coming years and decades, spurred on by enhanced policy support, alignment of climate and energy security goals, and more economic incentives6.

The opportunity of the low-carbon economy

Global investment in energy transition technologies reached a record USD 1.77 trn in 2023. Going forward it is set to reach USD 2 trn in 2024, driven by emission reduction goals, technology and efficiency gains, energy security (particularly in the EU), and the ambition to establish stronger market positions.

The situation in individual industries

Transport

Buildings

Industry

Agriculture

The net zero challenge

The Net Zero by 2050 goal needs estimated investments of USD 4.84 trn per year on average through 2030, three times what was invested in 20232.

- Electrified transport is set to become the largest contributor to energy transition investment, at USD 1.81 trn per year (37% of the total), followed by renewable energy (USD 1.32 trn per year) and power grids (USD 700 bn).

- Renewable energy investment is rapidly gaining momentum and, if this trend continues, it will account for two-thirds of the total investment needed to triple renewable energy capacity by 20306.

- Furthermore, in the 2040s, low-carbon investment is expected to account for 80% of total energy system investment, up from c. 60% now3.

- However, by 2050, an extra USD 500 bn per year is required to fully fill the gap in the International Energy Agency (IEA)’s Net Zero Emissions Scenario (which includes spending on renewables, grids, and battery storage).

The catalysts and policy drive

There are four main factors that need further development to ensure sufficient capital is directed towards the low-carbon economy3:

-

1.

Policy support

-

2.

Technological innovation

-

3.

Consumer and investor preferences

-

4.

Efficiency increase

Some examples of policies driving the low-carbon transition:

-

Inflation Reduction Act (USA)

-

EU Innovation Fund

-

China 4th Five-Year Plan (FYP) on Renewable Energy Development

-

European Green Deal and European Climate Law

The surge of a new clean energy economy, led by solar PV and electric vehicles (EVs), gives us momentum for a systemic societal shift in how we consume and produce. Investment in clean energy has increased by 40% since 2020, and the economic case for mature green energy technologies is strong.

Policymakers are increasingly enacting laws focused on reducing greenhouse gas emissions while providing incentives for low-carbon technologies. Ground-breaking regulations, such as the Inflation Reduction Act in the US and the European Union Climate Law, are paving the way for clean technologies to thrive in a clean economy.

Despite the increase in clean energy investment and the shift away from fossil fuels, the world needs to transition to a low-carbon future in an orderly manner so that no one is left behind. To ensure a just energy transition, it is vital to invest in reskilling and upskilling workers and communities.

1. https://www.iea.org/reports/net-zero-by-2050

2. https://about.bnef.com/energy-transition-investment/

3. https://www.blackrock.com/corporate/insights/blackrock-investment-institute/publications/mega-forces/low-carbon-transition

4. https://www.imf.org/en/Blogs/Articles/2023/12/05/benefits-of-accelerating-the-climate-transition-outweigh-the-costs#:~:text=Most%20importantly%2C%20lowering%20emissions%20will,green%20electricity%20and%20energy%20storage

5. Energy Transition Outlook. 2023. DNV

6. https://iea.blob.core.windows.net/assets/60fcd1dd-d112-469b-87de-20d39227df3d/WorldEnergyInvestment2024.pdf

Important Legal Information

This document has been prepared by Banco Santander, S.A. ("Santander") for information purposes only and is not intended to be, and should not be construed as, investment advice, a prospectus or other similar information material. This material contains information compiled from a variety of sources, including business, statistical, marketing, economic and other sources. The information contained in this material may also have been compiled from third parties, and this information may not have been verified by Santander and Santander accepts no responsibility for such information. Any opinion expressed in this document may differ from or contradict opinions expressed by other members of Santander. The information contained in this material is of a general nature and is provided for illustrative purposes only. It does not relate to any specific jurisdiction and is in no way applicable to specific situations or individuals. The information contained in this document is not an exhaustive and formal analysis of the issues discussed and does not establish an interpretative or value judgement as to their scope, application or feasibility. Although the information contained in this document has been obtained from sources that Santander believes to be reliable, its accuracy or completeness is not guaranteed. Santander assumes no responsibility for the use made of the information contained herein.